Tightening Up Offshore Money Laundering

Published / Last Updated on 04/05/2018

The Sanctions and Anti-Money Laundering Bill is passing through Parliament at present. Included in that is an amendment that will require British overseas territories to create ‘public ownership registers’ by 2020.

In short what this means is that many so-called ‘tax havens’ that allow international company and trust investment to have anonymous owners, will be asked to keep a register of ownership. This was not fully included in the Bill but looks like it will be. Previously, the Government had suggested it did not want to meddle and force overseas territories to comply.

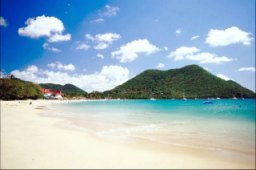

There are 14 named jurisdictions including the British Virgin Islands and the Cayman Islands (British West Indies). The bill is aimed at reducing money laundering globally.

Comment

You only have to think about the Panama papers, with the Queen, Prince Charles, MPs, US politicians, Russians and many famous people, sports people and wealthy people all being named in them to know that this will not just affect the criminal fraternity but also many wealthy and public figures.

Reality check: Successive government over decades and decades have allowed overseas territories to flourish using offshore finance (including dirty money) just so that the British Government does not have to support them.

Already, the Bahamas (now independent but in the Commonwealth) is famed for huge amounts of US wealth held there, has said it will not comply. Interesting times ahead. We wonder how serious the US and European Governments really are about making all areas of finance transparent and reportable?